Being made redundant is not an easy time but we are here to provide you with all the support and information you need.

Table of Content

How is redundancy page calculated

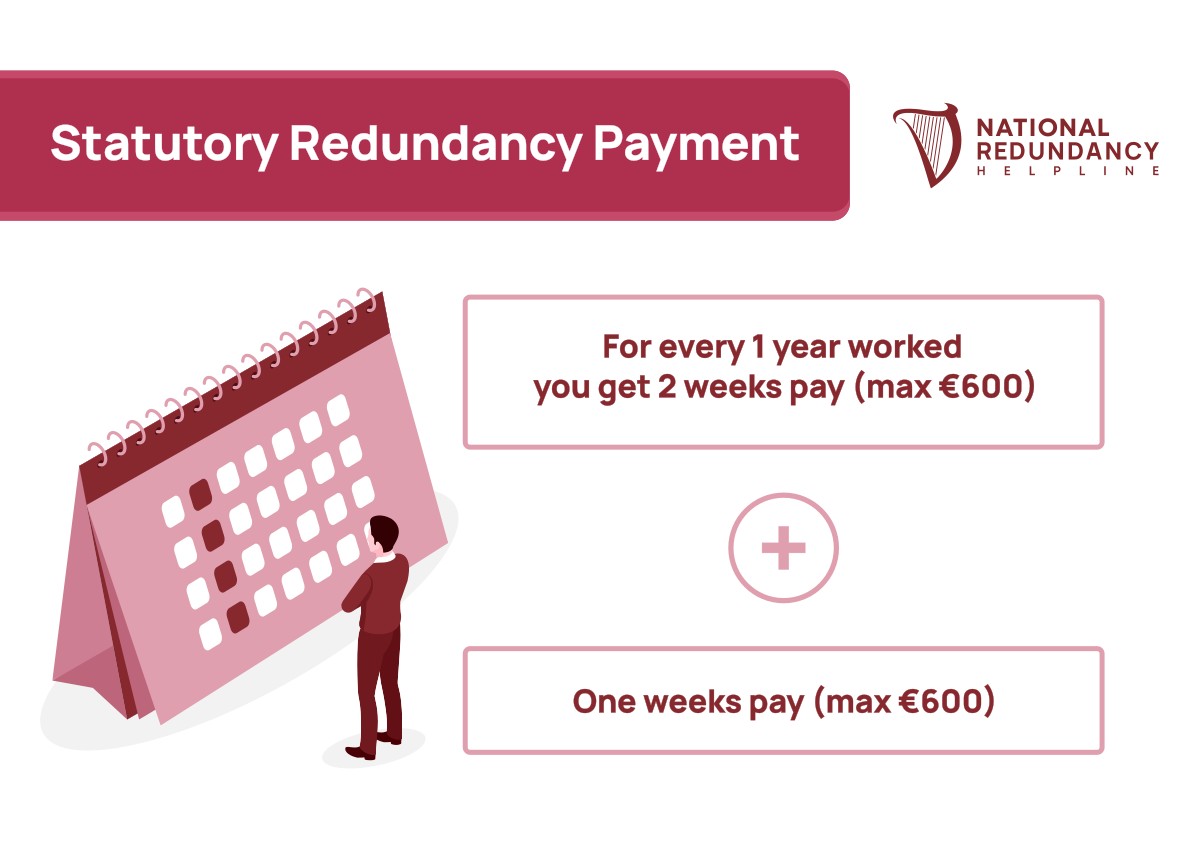

Redundancy page is calculated by:

- The sum of two week’s gross pay for every year of service (with a maximum limit €600 per week)

- In addition, you will also receive an additional one week’s pay on top of this sum. These payments are non-taxable.

The total of these 2 amounts make up the amount you receive in Statutory redundancy pay.

Am I entitled to my redundancy pay

You are entitled to a minimum redundancy payment if you meet the following criteria:

- You are aged 16 years or over (from when employment started)

- Your role is insurable under the social welfare benefits system according to PRSI Class A

- You have worked continuously in the employment for at least 104 weeks. **

- You work part-time and have been in continuous employment for more the two years.

- You have been let go for redundancy purposes

- All of the above apply to apprentices unless you are let go within one month of completing the course of the apprenticeship

Pension Implications of a redundancy

A key concern for your redundancy situation is the interaction between the redundancy payment offered and the accumulated pension contributions you have made with that employment.

In general, the lump sum payment you are offered is subject to PAYE but there are some exceptions which are outlined below.

Basic Exemption

The basic exemption is €10,160 plus €765 for every year of service. This option is a non-taxable redundancy payment (in addition to your statutory payment) and will still entitle you to tax free cash lump sum from your pension at retirement.

Example

You are offered a lump sum of €15,000 upon termination of the employment after 12 years of service. The basic exemption in this case would be 19,340 ([€10,160 plus (€765 x 12]). In this case, the lump sum amount of €15,000 would not be taxable as it is below the basic exemption amount, €19,340 in this case.

Increased Exemption

There is also an option for an additional €10,000 to be received from your redundancy payment tax free. This option can be applied with the assumption that you do not have a current pension plan with your employer, or that you voluntarily wave your entitlement to a tax-free lump sum from your pension when you decide to retire.

Example

You are offered a lump sum of of €25,000 upon termination of the employment after 14 years of service, and you are not a member of a pension scheme. The increased exemption in this case would be 30,870 [(€10,160 + €10,000) + (€765 x 14)]. In this case, the lump sum of 25,000 would not be taxable under the increased exemption amount, €30,870 in this case.

It is important here that you check what tax-free lump sum you would be entitled to under your pension plan with this employer. Moreover, if you decide to take this enhanced benefit of €10,000, you will only receive this figure minus the sum you would have available in your occupational pension plan associated with this employment.

Example:

You are offered a lumpsum of €35,000 upon termination of the employment after 14 years of service. The current value of your pension scheme entitlement is 4,000. The exemption in this case would be 26,870 [(€10,160 + €6,000) + (€765 x 14)]. The increased exemption of €10,000 is reduced by the amount receivable from your pension scheme.

If the amount receivable in your pension is higher than the increased exemption, you will not be entitled to this option.

Example

You are offered a lump sum of 40,000 upon termination of the employment after 12 years of service. The current value of your pension scheme entitlement is €60,000. In this case you would not qualify for the increased exemption as the lump sum of your pension entitlement is worth more the 10,000 you would receive. The basic exemption in this case would be €19,340 (€10,160 plus (€765 x 12). As a result, the remaining €20,660 would be taxable.

Important to note: the above examples are not including the statutory redundancy payment, which is a non-taxable amount in addition to the exemptions outlined above.

What is a SCSB

The SCSB tax is a form of tax relief to benefit employees with larger salaries or who have higher earnings or who have worked in a company over a long period. This formula can be used of the tax-free benefit if the calculation is higher than the Basic or Increased Exemption methods above. Below you can see its calculation:

Average salary over recent 3 years) x (total years of service)

(Divide this number by 15) =

(Minus the lump sum pension payment that could be received)

Should I accept a redundancy offer?

Your decision to accept a redundancy offer is dependent on the personal situation you find yourself in.

It might be a basic maths question for you to make based on what will bring you in more money.

You may decide to take a higher redundancy payment now while waiving your future right to a tax-free lump sum from your pension. This might be a desirable option if having more money at your disposal now is more important to you.

Otherwise, it might be a situation where you have found a new job with attractive pension benefits and the idea of having access to that lump sum is more appealing upon retirement.

Max you can receive on your on redundancy and pension tax free

You have a lifetime limit of €200,000 tax-free for redundancy payments and a lifetime limit of €200,000 tax-free for pension lump sums.

How soon after redundancy will I receive my redundancy package

The redundancy payment should be paid to you when your employment ends. This can be on the final day of employment or alternatively on your next day in the employment’s payroll.

Learn more about how to manage your finances post redundancy

To learn more about your redundancy and how to best manage your post redundancy finances, take our online assessment to speak with a Qualified financial Adviser best suited to your needs.