Redundancy in Ireland: Everything you need to know

Being made redundant does not have to be a daunting experience. Redundancy is a complex topic with many layers.

If you find yourself in this situation it is important to understand the numerous implications of being made redundant to ensure you receive exactly what you are entitled to with minimal fuss.

With that in mind, we’re breaking down each section so you don’t have to.

What is redundancy?

An employee can be made redundant when their job in a company ceases to exist. This can only occur when the employer has no intention of finding a replacement individual to fill that particular role.

Should an employee aged 16 or older with 104 weeks’ continuous service be approached for redundancy, they are entitled to some kind of financial compensation. This is known as a tax-free statutory redundancy payment.

The statutory redundancy payment consists of:

- two week’s gross pay per year of service up to a ceiling of €600 per week

- plus, one week’s pay, which is also subject to the ceiling of €600

It is important to note that some employers can make redundancy agreements above the statutory rate.

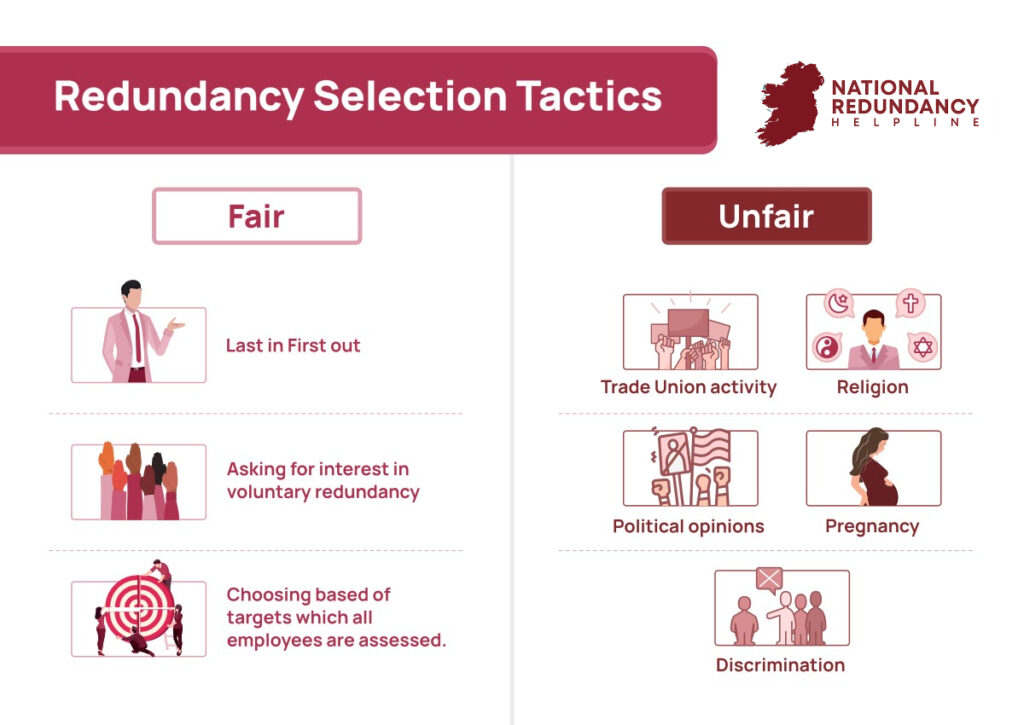

Fair redundancy selection

In all cases, employers should make redundancy selections using a fair and objective system, meaning you should be able to understand the unbiased and factual reasoning behind their decision.

To ensure things are being done properly, there are a few methods you should be able to recognise your employer using.

Firstly, to note that if a certain way of deciding redundancies has been agreed by your trade union, your employer is following those guidelines.

After that, it is entirely up to your company to decide how they want to proceed, provided their actions and are fair and reasonable.

Some selection methods to be aware of are:

- Last in, first out ,whereby the newest staff member is the first to be let go

- Asking teams for any interest in voluntary redundancy

- Points systems tallied on objective criteria implemented into teams against which all employees are assessed (i.e. attendance, working standard, qualifications, skills)

Examples of unfair redundancy claims are as follows:

- Trade union activity

- Religious reasons

- Political opinions

- Pregnancy

- 9 grounds for discrimination

Minimum redundancy notice period

If you are to be made redundant by an employer, you can expect to be served with a Notice of Proposed Dismissal for Redundancy (Form RP50 (Part A)).

After having received this, you can still make the decision to leave the company before the suggested time frame in the document – for example, to take up another job offer, but before you make that choice you must be aware of the risks.

Leaving outright before a term ends may cause you to lose any entitlement to redundancy payments. However, this can be avoided by submitting a notice to your employer in writing using Form RP6.

The employer then has discretion to choose whether to grant the request. If this is denied and you still decide to leave the company, your redundancy payment may fall through.

You can also submit employer notices of redundancy claims via Form RP9, if you have been laid off or are short-time working for 4 weeks or more.

Legal entitlements to redundancy pay

Another point to touch on is that not all employees are entitled to claim a statutory redundancy package. There are terms and conditions under the Redundancy Acts attached to making a claim.

The claimant must meet the following criteria:

- Be aged 16 or over

- Be in a role that is insurable under the social welfare system for all benefits according to PRSI Class A

- Hold a continuous working streak for at least 104 weeks

- If a part-time employee, been in continuous employment for more than two years

- All of the above apply to apprentices unless they are let go within one month of completing the course of their apprenticeship

How much redundancy pay will I get?

With regards to a statutory redundancy payment, the amount you are entitled to is called a lump-sum payment and is based on the individual pay of the employee being let go.

This will be calculated against:

- Two weeks’ pay for every year of service since entering the workforce at 16

- One additional week’s pay

While the lump-sum is tax-free, the amount is subject to a maximum earnings limit of €600 per week which adds to €31,200 per year.

If you need help calculating your expected sum, you can set up an appointment with us for independent advice or use the Department of Employment Affairs and Social Protection redundancy calculator on their website.

Is there a time when redundancy is not legally required to be paid?

You will not be legally entitled to statutory redundancy if you cannot meet the eligibility criteria listed in the sections above.

Another case that may impact your chances of receiving a lump-sum arises with the prospect of a new job offer in that company.

An employer may refuse to pay out redundancy and instead find a new role for an employee within the business.

In this case, if you accept a contract or re-engagement with immediate effect and the terms of this scenario are the same as your previous contract, you will lose your claim to redundancy.

Similarly, should you accept an offer in writing from your employer for a new role that begins within four weeks of your previous contract ending, you are no longer entitled to redundancy.

A refusal of a reasonable job offer without suitable justification will also lose you your entitlement to a redundancy pay-out.

Tax implications of redundancy payments

In some cases, receiving a large lump-sum after being laid off could have tax implications. Whilst the offer may seem generous when it lands on the table, it is important to seek independent advice to check how much of that sum you will actually see in your account.

Before diving in, payment types that do not have to fear the Taxman are:

- Statutory redundancy lump-sum

- Payments made on account of death, injury or disability limited to a lifetime sum of €200,000

- Payments made to employees as a result of employment law rights claims

The following are subject to tax but can apply for some relief:

- Ex-gratia payment which is a non-statutory redundancy payment paid by your employer, that falls above the statutory redundancy payment

- Payment in lieu of notice provided it is not paid under the terms of your contract as this will mean it is taxable in full and does not qualify for exemption or relief

The rate of tax that applies causes the balance, i.e. the taxable lump sum payment, to be treated as part of your total income and is therefore taxed as part of your current year’s income.

Will redundancy affect my pension?

Should you find yourself being made redundant by an employer, you will no longer be a member of that company’s pension scheme and therefore will stop making contributions.

However, there are options available to make sure you are still adding to a pension despite being laid off. These are as follows:

- Leaving the accrued value in the scheme where the funds will continue to be invested until you reach retirement age

- Transfer your accrued value to your new employer’s scheme where your funds will be subject to the rules of their pension options

- Switch to a Buy Out Bond, otherwise known as Personal Retirement Bonds, where you will have complete control over how your money is invested

- Move to a Personal Retirement Savings Account (PRSA), where your funds won’t be accessible until the age of 60 unless you are retiring from employment

Depending on the type of pension scheme you are on and the rules attached to it, you may be able to get a refund of your pension contributions on being made redundant.

We’re aware this information can become overwhelming, so eliminate the stress of wondering what to do next by setting up a meeting with us.

As qualified professionals and experts in the field, we can point you in the right direction to make redundancy a seamless process.

Learn more about redundancy and your pension

The National Pension Helpline is here to help you better understand your pension and help you be in the best position possible for your retirement.

To learn more about how redundancy may affect your pension and how to best manage your pension, make an inquiry below and a member of our team will be in touch with you.