Being made redundant from your employment is a difficult and stressful time. Although you will receive a redundancy payment, you will still have concerns about your finances following redundancy.

If you were made redundant during the year and have paid some income tax and USC (Universal Social Charge) you may be able to claim a refund of income tax and USC in certain situations when you become unemployed.

A redundancy occurs where the business you work for closes down, or your job no longer exists and you are not replaced.

Can I claim tax and USC back after redundancy?

If you are a PAYE worker, your tax and USC is calculated based on 12 months’ salary or wages.

If you are paid monthly, for example, the tax and USC you pay each month is based on you being paid every month and, at the end of the year, the appropriate tax and USC will have been paid.

However, if you become unemployed during the year you may have paid too much tax as the amount you will have paid is based on you being employed for the full twelve months. The reduction in your income makes your total annual income lower so less tax is owed.

This may mean that you are entitled to a refund of tax and USC.

How much am I refunded?

This depends on how long you have been employed, the amount of tax you have paid and the tax credits you are entitled to.

It is also affected by the amount and type of social welfare payment you receive. Jobseekers’ benefit is taxable on any amount above the first €13 per week, for example.

So where Jobseekers benefit is your sole source of income for a year you would be unlikely to pay tax on this payment, but where you have been in paid employment for part of the year, you may be liable for some tax and this may affect the amount you are refunded.

How do I apply for a tax and USC refund?

You can apply for a tax and USC refund through myAccount on Revenue.ie, under PAYE services. Your employer will provide Revenue with your pay and tax details and your leaving date when you cease employment.

If you look for ‘Claim unemployment repayment’, you will usually be able to apply online. Alternatively, you can complete a Form P50 and send it to Revenue.

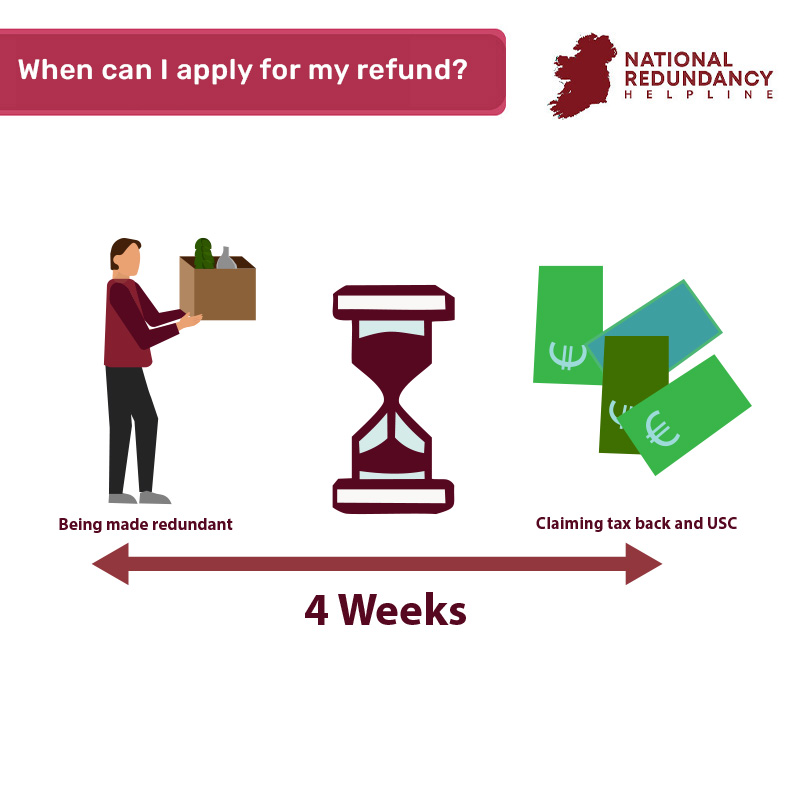

When can I apply for my refund?

You can apply 4 weeks after you become unemployed, if you are not in receipt of any other income.

If you were paying emergency tax before redundancy, you may be able to apply immediately. Emergency tax is a higher rate of tax paid for a temporary period in employment, usually at the start of your employment so this may not apply to redundancy.

If you are leaving Ireland permanently, you may apply for a refund of tax and USC immediately.

If you are receiving Jobseekers Benefit, or receive another income or social welfare payment which is taxable, you may apply for your tax and USC back after 8 weeks.

Is my redundancy payment taxable?

If you receive the statutory redundancy lump sum amount, this is not usually taxable.

An ex-gratia payment or higher lump sum negotiated by yourself or a trade union, for example, may in some circumstances be taxable, although there are exemptions available.

You may need to pay tax on a redundancy payment when it is paid and later apply for a tax refund. This may also affect your entitlement to claim tax back on your income from employment.

National Redundancy Helpline

Redundancy payments and taxation of redundancy or severance payments as well as income tax and USC refunds can be complex.

National Redundancy Helpline offers free and unbiased, expert redundancy information and support.

You can avail of a free consultation with an expert redundancy advisor if you are an employee or an employer from National Redundancy Helpline.