Redundancy is something that can impact people all over Ireland. No matter what age you are or profession you are in, it is always something that can have negative implications on households.

Being prepared for redundancy is not something a lot of people do. After all, no one likes the idea of losing their job in the future and there may not be signs to indicate it might happen to you.

However, the more prepared you are the less stressful a situation like this would be should it occur.

If you are someone who is facing redundancy now without any preparation, then it likely feels stressful and intense. This can especially be the case for people who are slightly older.

Redundancy is absolutely something you can bounce back and recover from however. Although things may seem stressful now, there is a resolution to work towards and options to choose from.

At the National Redundancy Helpline, we are here to help anyone who has been cast in this unfortunate situation.

Why does redundancy happen?

Some people may find it hard to accept redundancy, or understand why it happens. Redundancy is when a company needs to downsize or reduce the number of staff in which they employ.

Redundancy is not the same as contract termination.

Redundancy may occur when a business is facing a tough period financially, reorganisation changes the needs for jobs or relocation occurs.

When you are being made redundant, your position cannot be filled. It is essentially the company terminating a job role, as opposed to an individual.

What to do when you have been made redundant later in life

Redundancy can happen to any person, at any age. If you have been made redundant later in life, you may feel stressed and unsure of what to do.

As an older person, you still have plenty of options following redundancy. Here are some of the things you should do following being made redundant.

Don’t panic

Losing your job in any kind of circumstance is by no means a pleasant experience. However, it is important not to panic.

Although you may start to feel the pressure and implications of losing your job immediately, staying composed can be very beneficial. The quicker you are able to control your panic and get focused again, the sooner you can work towards a solution.

Talk to loved ones

One thing that can really help you to feel settled and secure is to talk to loved ones. Even if you aren’t talking about redundancy with your loved ones, you can still gain comfort from them.

Take some time to try and distract yourself from the situation. In a panic, many people rush into the wrong things.

Of course, there is a time and place to get back on your feet and to work towards a solution. However, spending time with loved ones and composing yourself for a short period of time can really prove beneficial.

Seek professional advice

One of the best things you can do as a response to redundancy is to seek professional advice. At the National Redundancy Helpline, we are happy to help in any way we can.

By getting professional help not only will you feel better about the situation, but you can also get advice regarding what direction to go in the future.

Financial considerations

It is likely that you will have to make some adjustments in regard to how you spend your money following redundancy. Not making adequate changes could put you under a lot of financial strain.

Once you are made redundant, take a look at all of the expenses you will still face despite being without income. This will include the likes of bills, groceries and other living costs.

Even if you feel financially secure due to savings, it is a good idea to make considerations in regard to your luxury spending. Some ways in which you can cut down on luxury costs include the following:

- Changing to cheaper brands for groceries

- Reducing streaming subscriptions

- Avoid eating and drinking out

- Purchase cheaper clothing items

It is beneficial to make a budget following redundancy also. Outline how your savings and redundancy payment may look following bills and necessity costs.

Having an effective budget can allow your money to be stretched further.

Consider your options

Once you have faced the immediate aftermath of redundancy, you can now aim to work towards a solution and begin your next steps.

As an older person, there are still plenty of viable opportunities awaiting you. What you need to decide is what is the most beneficial to you.

Here are some examples of some of the options you may want to consider:

New job

The most common next step following redundancy is aiming to get employed in a new role. If you have significant experience in a certain industry, then this can make the process much easier.

Now might also be the time to decide that you want to make a career change. Although it might seem daunting, if there is an industry you aspire to work in, now could be the time to strive towards that.

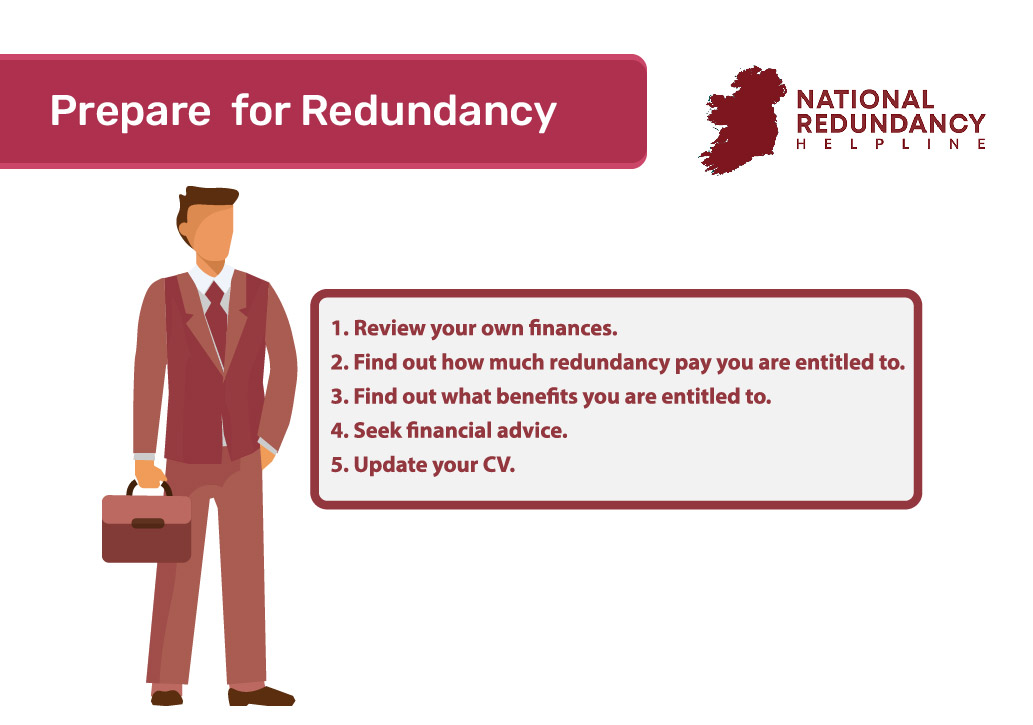

Whether you are staying in your previous industry or switching to a new career, you should make sure that your CV is updated and as strong as possible.

A great CV will contain the following:

- Contact details

- Relevant experience

- Education and qualifications

- References

- Easy to read layout

Gig work or freelance

If you have significant experience in a certain industry, you may find success as a gig worker or a freelancer.

This realm of work will benefit service workers the most and can be very profitable if done right.

Although gig work may not offer as much stability as employment, it can provide valuable flexibility for people of an older age. Depending on what your financial situation is like, more free time could be as valuable to you as income.

Being a freelancer can be relatively straightforward, no matter what age you are. Some basic tips to find success in gig work can include having a strong online presence, showcasing previous professional work and having effective communication skills.

Time off

Having savings can benefit everyone. It is the strongest way to prepare for redundancy and will open up more options for you in the aftermath.

One of the best options it can provide to older people is time off.

After working for consecutive years in the same industry, it is not unusual that people would like some time off. Being able to take some time to yourself is a luxury not a lot of people have, however it can be the best option.

By taking time off, you can really be sure about what your next step will be. If you are unsure as to whether or not taking time off is the right choice for you, speak to our team today for advice.

How to be financially prepared for redundancy

It is very difficult to predict redundancy. However, it is always worthwhile to be prepared for it.

You will likely never feel fully secure when being made redundant, however preparation can provide peace of mind and more options in the future. Some examples of how you can financially prepare include:

- Saving money on a consistent basis

- Cutting down on costs

- Avoid loans whenever possible

- Being financially responsible

Contact us today

Redundancy is a tough period for any person to go through. That is why the National Redundancy Helpline is here to help anyone who needs it.

Our team can support and advise you in any way that they can. Just get in contact today and we can begin working towards the best solution for you and your loved ones.