Redundancy is a very stressful situation for employers and employees. When being made redundant as an employee, your first reaction may be concern for your personal finances.

Understanding your statutory redundancy entitlement may give you some peace of mind. Be reassured that Irish redundancy law offers some protections for employees who are made redundant.

The National Redundancy Helpline offers expert redundancy advice and support for employees and employers who find themselves in a redundancy situation. Our financial advisors can assess any redundancy lump sum you have been offered and advise you.

Table of content

What is statutory redundancy?

Statutory redundancy pay is the minimum lump sum payment that is paid by employers to employees who have been selected for redundancy.

There are many conditions that your employer must satisfy before they can make you redundant, and they must also, by law give you notice before your employment ceases.

For employers, under redundancy law in Ireland you have the right to make eligible employees redundant if there is a genuine business reason and you set fair selection criteria for redundancy.

Redundancy

Redundancy occurs when an employer closes their business or your job no longer exists and you will not be replaced after you no longer work for your employer.

Your redundancy must be for a genuine reason such as a financial reason (eg. cost cutting or company restructuring), there is a lack of work or your role is obsolete, or the business is closing.

Dismissal through redundancy, as opposed to dismissal for reasons personal to you such as conduct or competence, demands that your employer follow fair procedures and uses reasonable grounds for your selection e.g. first in last out or a points system.

Your employment contract may also show criteria for selection for redundancy. If an agreement with a workplace trade union is in place, then your employer must follow this.

Collective redundancy occurs when an employer makes a certain proportion of their workforce redundant in a 30 day period.

There are alternatives to redundancy. Your employer may offer you ‘alternative work’, which is another role within the business.

Compulsory and voluntary redundancy

Compulsory redundancy occurs when the employer selects one or more employees for redundancy following the procedure required by legislation.

Prior to making employees compulsorily redundant, an employer may offer non compulsory redundancy. this means that the employer asks employees to volunteer for redundancy or offers incentives for early retirement.

Redundancy notice periods

If you have been made redundant, your job will not finish immediately. By law there are minimum paid notice periods. These depend on your years of service in your employment.

| Time spent with the company | Notice Period |

| 13 weeks – 2 years | 1 Week |

| 2 years – 5 years | 2 Weeks |

| 5 years – 10 years | 4 Weeks |

| 10 years – 15 years | 6 Weeks |

| 15 years + | 8 Weeks |

Your employer must give you notice of your redundancy in writing, ‘Notice for Proposed Dismissal for Redundancy (Form RP50 (part A)’, and this notice must include a finishing date.

Leaving your employment

If you wish to leave your employment before your redundancy notice period expires, you may do so but you must use Form RP6 Leaving before a Redundancy Expires, or you may not be paid your statutory redundancy payment. Employers may also offer you pay in lieu of notice.

Lay offs and short-time working

These situations may occur where a business is in financial trouble or there is little work available.

A lay off occurs where there is no work for you to do for a certain period and you are not paid.

Short-time working occurs where you work for less hours than usual due to a shortage of work.

If you do not agree to a lay off or short-time working, you may be made redundant. Likewise if your lay off goes on for a certain period of time, you may be made redundant.

In either situation, you may be entitled to a social welfare payment from the Department of Social Protection.

Qualifying for a statutory redundancy payment

There are conditions that eligible employees must satisfy to receive their statutory redundancy entitlement.

Employees must be aged over 16 and have over 104 weeks (2 years) continuous employment with their employer in fully insurable employment in order to be entitled to a statutory redundancy payment by law.

How is statutory redundancy calculated?

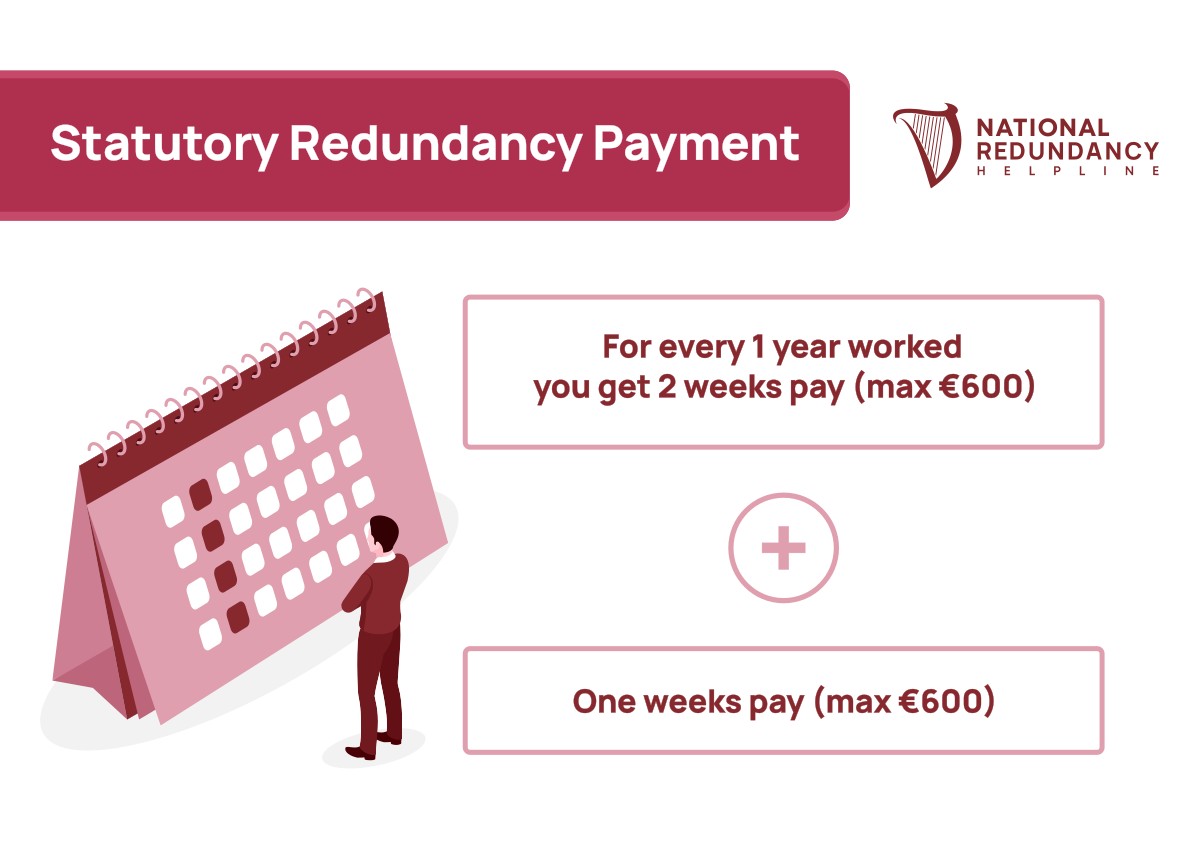

Calculating a redundancy payment, or redundancy lump sum, depends on the length of continuous employment of the employee as well as their normal weekly pay.

A statutory redundancy payment is calculated as two weeks’ normal, gross weekly wage for every year of your service plus a bonus week.

There is a ceiling of €600 per week on your two week’s gross pay and also on your bonus week even if your normal pay is higher. This means that income above €31,200 is not considered in a statutory redundancy pay calculation.

The Department of Social Protection has a useful tool for calculating statutory redundancy pay on their website.

Redundancy Taxation

This lump sum payment is tax free so you do not pay income tax or Universal Social Charge (USC) on your statutory redundancy payment.

Some employers may pay a higher rate of redundancy payment and any additional lump sum in this case may be subject to income tax and USC.

How are redundancy payments paid?

Employers are responsible for paying any redundancy lump sum payable to their employees.

Where an employer is unable to pay the statutory redundancy payment, there is a Redundancy Payment Scheme available through the Department of Social Protection for a minimum redundancy payment to be made to employees.

Employers should pay your redundancy pay when you finish work or on your next usual payday. Employers should give you a written statement that outlines how your redundancy pay was calculated.

If your employer does not pay your lumpsum you can apply to your employer for using Form RP77 Claim by an Employee against an Employer for a Lump Sum or Part of a Lump Sum.

Appealing wrongful redundancy

If, as an employee, you believe the reasons for your redundancy were not genuine, or that you were unfairly selected for redundancy or that you were not offered available alternative employment, you can appeal your redundancy.

If the employer refuses to pay the appropriate redundancy payment or there is a dispute about redundancy, the employee may bring a claim to the Workplace Relations Commission (WRC) within 6 months.

National Redundancy Helpline

Understanding the laws around redundancy and redundancy pay in Ireland is essential for employers and employees.

Following the correct process and having regard to the rights and responsibilities of everyone involved will help the process to go as smoothly as possible.

The National Redundancy Helpline can offers free, expert redundancy advice to employers and employees on redundancy and independent financial advice on your redundancy payment.

Use our inline form to request free advice, email us or call us today about statutory redundancy.